Cable Technology Feature Article

Will Consumers Cut Mobile, Broadband, Fixed Line Spending in 2011?

By Gary Kim, Contributing Editor

By Gary Kim, Contributing Editor

Virtually all retailers, including those selling communications and video entertainment services, know the recent "Great Recession" and halting recovery have consumers being quite cautious about their discretionary spending. Even in markets where growth is fairly healthy, such as mobile services, or in broadband, which might now be considered a "must have" service, consumers have been indicating in surveys that they are considering, or already have cut back on their purchasing.

A new survey conducted by Ofcom, the U.K. communications regulator, suggests that although the magnitude of cost cutting might become less severe in 2011, consumers still think they will be spending less on mobile, video, broadband and voice services.

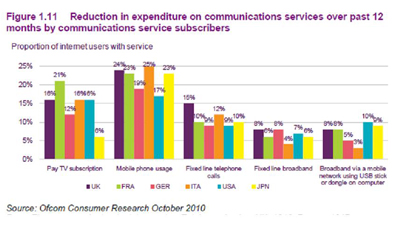

The survey found users reduced their broadband expenditure broadly consistently across the survey countries, ranging from eight percent in the United Kingdom to four percent in Italy.

U.K. consumers were more likely than those in the other five countries to have reduced spending on fixed-line telephony over the previous 12 months, with 15 percent saying they had done so, compared to nine percent to 12 percent of respondents in most of the other countries surveyed by Ofcom.

U.K. consumers were more likely than those in the other five countries to have reduced spending on fixed-line telephony over the previous 12 months, with 15 percent saying they had done so, compared to nine percent to 12 percent of respondents in most of the other countries surveyed by Ofcom.

About six percent of Internet users with pay TV in Japan stated that they had reduced expenditure on pay-TV services over the previous 12 months, compared to 21 percent in France, with 16 percent in the UK saying they had reduced spend on this service.

Of course, all that is nearly in the rear mirror. When asked what they will do in 2011, consumers generally indicated their behavior would be similar to what it was in 2010, though the magnitude of spending reductions appears to be lessened. What does stand out, though, is that consumer spending reductions might hit mobile services harder than fixed-line voice, fixed-line broadband or multichannel video entertainment services.

Across all countries, respondents said they were more likely to reduce their expenditure on mobile telephony over the coming 12 months than on other communications goods and services.

In the United States, 12 percent of respondents said they would reduce spending on multichannel television services. The same percentage indicated they would reduce mobile spending. Just seven percent of U.S. respondents said they planned to reduce fixed-line voice spending, while six percent indicated they would reduce spending on fixed-line broadband.

About 10 percent of U.S. users suggested they would reduce spending for dongle-based wireless broadband service.

About the only good news for communication service providers is that respondents said they'd be reducing their spending on other products even more. About 36 percent of U.S. respondents said they would be reducing spending on "nights out" or "meals out of the home." About 28 percent said they'd be reducing vacation or weekend travel. A quarter indicated they would cut back on furniture purchases.

About 26 percent of U.S. respondents said they would reduce spending on clothing or footwear; 19 percent indicated they would reduce spending on groceries; while 16 percent said they'd cut back on personal care, toiletries or cosmetics. About 24 percent indicated they would slice spending on music, books and DVDs. Some 16 percent said they would cut newspaper spending.

With the caveat that consumers do not always behave as they say they will, those trends suggest a tough 2011 for many retailers, and no easy year for communications or entertainment video providers. The upside is that the magnitude of possible reductions seems less than what respondents said they did in 2010.

However, while 24 percent of U.K. respondents with mobiles said that they had reduced their mobile spend in the past year; just 14 percent said they intended to do so in the next 12 months, compared to 23 percent in Japan and 20 percent in France.

Likewise, 12 percent of U.K. consumers said that they planned to reduce expenditure on fixed-line telephone calls in the next 12 months, compared to 15 percent who said that they had reduced expenditure in the previous 12 months.

This may reflect an ongoing trend of consumers shifting toward mobile instead of fixed line for voice calls, Ofcom speculates.

If many mobile customers in the United States and other European countries reduce the amount of money they spend on mobile services in 2011, they might be doing so for reasons you might not initially suspect. Because of the severity of the "Great Recession" and the struggling recovery, the easiest assumption to make is that people are cutting back on communications and mobile spending like they are trimming in many other areas as well.

That is partly correct. But the other angle is that service providers are offering packages that can reduce a consumer's spending, sometimes offering greater utility and value as well, for less money on a recurring basis. The most recent example might be Verizon (News ![]() - Alert) Wireless 4G service, which offers access at 12 Mbps where the 3G network might offer 1 Mbps, at a monthly cost of $50, where the 3G service cost $60 for an equivalent 5 Gbytes of usage.

- Alert) Wireless 4G service, which offers access at 12 Mbps where the 3G network might offer 1 Mbps, at a monthly cost of $50, where the 3G service cost $60 for an equivalent 5 Gbytes of usage.

A customer switching from 3G to 4G service will show up as a person "reducing" communications spending, but not necessarily for any reason related to the economy. Rather, that customer might simply be swapping out a lesser-functionality service for a higher-functionality services that also happens to cost less.

Another more-established trend is for consumers to swap a postpaid mobile service, costing more, for a prepaid service costing less.

In 2010, for example, a significant number of consumers were likely to have reduced their expenditure on mobile, with over a fifth in the United Kingdom, France, Italy and Japan having done so in the previous 12 months, a little ahead of Germany at 19 percent, Ofcom said.

In contrast, people in the United States were least likely to have reduced expenditure, with 17 percent doing this in the previous 12 months.

The wording of consumer surveys often is such that respondents are asked whether they will "cancel or reduce" a specific category of service. That phrasing does not capture the difference between "disconnecting" and "paying less."

In fact, the Ofcom report generally finds stable usage in European countries, with declining spending, indicating that consumers simply are taking advantage of better offers from service providers.

The Ofcom study, conducted online, obviously skews toward users with broadband service, and was conducted between October 2009 and October 2010, in the United Kingdom, France, Germany, Italy, the United States and Japan.

Gary Kim (News - Alert) is a contributing editor for TMCnet. To read more of Gary’s articles, please visit his columnist page.

Edited by Tammy Wolf