Cable Technology Feature Article

Cord Avoiders a New Problem for Video Providers

By Gary Kim, Contributing Editor

By Gary Kim, Contributing Editor

About 200,000 fewer subscribers will ante up for paid TV services in 2012, analysts at Credit Suisse predict. In large part, the modest contraction can be blamed on weak formation of new households and a growing number of new households that are avoiding subscription TV subscriptions altogether.

More than "cord cutting," the abandonment of video services by customers that used to buy such services, the new weakness is among people who would otherwise have been starting their own households or becoming potential consumers for the first time.

The Credit Suisse analysts emphasized that they remain optimistic on cable and satellite sector businesses, but see the developing new problem as "cord-avoiders," households that are relying on video alternatives in an arguably new way.

Many new households are not signing up for cable or satellite, the analysts said. While there were 1.8 million households formed, according to U.S. Census estimates cited by the report, only 16.9 percent of them signed up for video entertainment services.

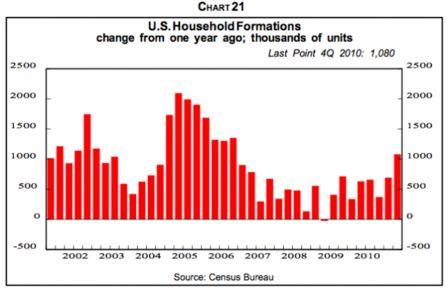

Household formation is weaker than in the first half of the decade of the 2000s.

Analyst Stefan Anninger says he now expects the multi-channel video universe to contract by around 200,000 subscribers in 2012 instead of the gain of 250,000 that he had previously forecast.

"We do not expect the pay TV universe subscribers 'to fall off a cliff' over the next year or two," he said. Base business okay But there is trouble brewing.

For the 12 months ending Sept. 30, 2011, total pay TV industry subs have remained unchanged at 100.8 million, according to Anninger. "Over the same period, however, occupied households have grown by 1.25 million," he said. "In turn, pay TV penetration has fallen from 84.1 percent in the third quarter of 2010 to 83.2 percent."?? Cable and Satellite TV Subscriber Rolls to Shrink in 2012

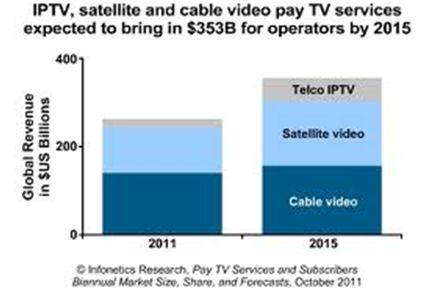

The global TV forecast also is characterized by a shift of market share to satellite and telco competitors. “DTH [DBS] revenues will overtake cable TV revenues in 2011,” argues Digital TV Research.

“DTH revenues will reach $86 billion in 2016, up from $71 billion in 2010. DTH will command nearly half the total revenues by 2016, up from 43 percent in 2006,” according to Digital TV Research. Satellite a bigger factor

But some observers do think actual cord cutting is growing. The number of multichannel subscription TV households in the United States declined by nearly 380,000 in the second quarter of 2011 as traditional cable and satellite video providers continued to lose subscribers because of economic factors and lower-priced Internet video solutions, according to new IHS (News - Alert) Screen Digest ?ndings from information and analysis provider IHS. Some think cord cutting is growing, though.

The noteworthy angle here is that IHS does believe over-the-top online video is having an impact. Most observers say customers are "cutting the cord" to save money, or because they are not so interested in TV, but not specifically to watch online alternatives. IHS thinks the substitution is happening.

Total U.S. TV subscriptions in the second quarter—the latest time in which full ?gures are available— decreased to 100.9 million, down from 101.4 million in the ?rst quarter.

Overall, the loss of approximately 378,000 households during the period was much greater than the increase of 345,000 seen in the fourth quarter of 2010. The decline also reversed much of the gains that occurred in the ?rst quarter this year when some 461,000 subscriber households had signed on to new services. The last time a loss of this magnitude took place was a year ago in the second quarter of 2010, when the industry dropped approximately 249,000 subscribers.

US Pay-TV Subscriptions Decline by 380,000 in Q2

Gary Kim (News - Alert) is a contributing editor for TMCnet. To read more of Gary’s articles, please visit his columnist page.

Edited by Rich Steeves