Cable Technology Feature Article

A Small, But Important Change in Video Business

By Gary Kim, Contributing Editor

By Gary Kim, Contributing Editor

Madison Square Garden Co.'s sports networks won't be available for Time Warner Cable Inc. subscribers in 2012, meaning New York Knicks and Rangers games apparently will not be available on Time Warner Cable systems in the New York area.

The unusual inability to come to terms is significant. Contract disputes are normal in the video distribution business. But such disputes, though often getting close to the point where a "blackout" might occur, normally get resolved without service interruption. Time Warner Cable Says "No"

This is the first case I can recall when a major network and a major distributor actually were unable to come to terms, meaning an actual programming blackout for a full year.

If the deal is not somehow reached later, it might represent a watershed in the video subscription business.

Though programmers and content providers obviously would prefer to be paid more every year for access to their content, distributors are in a bind as programming costs continue to drive retail end user prices higher, reducing demand for the product.

And since sports programming generally is considered to be a principal driver of programming cost increases, the carriage discussions have an added significance. Apparently, as important as Knicks and Rangers games are in the New York market, Time Warner Cable is "drawing a line in the sand" against what it sees as ever-higher programming costs. Programming cost squeeze

The gamble is not without risk. Few cable, satellite or telco video distributors would be willing to risk losing anchor programming such as ESPN, considered a staple of video service packages.

On the other hand, regional or "specialized" sports packages, at least in this case, are viewed by Time Warner Cable as a place to start changing the conversation. Some might argue the conversation is long overdue. Sports programming costs an issue

The other key issue is not simply “channel” offerings, but the potentially bigger move to a la carte buying of discrete programs.

How big does a video content distributor have to be to gain the upper hand in licensing deals with content owners? The answer matters when it comes to any potentially big changes in video entertainment distribution.

Up to this point, even the largest U.S. cable operators, though able to win volume discounts, have not had the dominant role in the business relationship, at least in recent decades, one might argue. The largest programmers, with the "anchor" channels, essentially have been able to dictate placement on programming tiers and force bundling of multiple networks.

In other words, contracts generally forbid sales of channels a la carte, which would represent one potential source of innovation. So far, Comcast, Time Warner Cable, AT&T, DirecTV, Dish Network, Verizon (News ![]() - Alert) and others have lacked leverage. Audience matters

- Alert) and others have lacked leverage. Audience matters

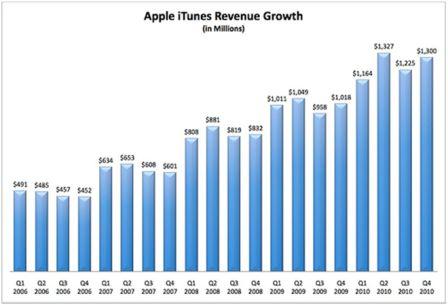

But then there's Google (News ![]() - Alert), Apple and Amazon. Apple's iTunes customer base arguably got to be so large that music publishers had to do business with Apple on the general terms Apple (News

- Alert), Apple and Amazon. Apple's iTunes customer base arguably got to be so large that music publishers had to do business with Apple on the general terms Apple (News ![]() - Alert) wanted. That includes such basic matters as retail pricing, royalty rates and ability to "unbundle" discs and sell songs one at a time.

- Alert) wanted. That includes such basic matters as retail pricing, royalty rates and ability to "unbundle" discs and sell songs one at a time.

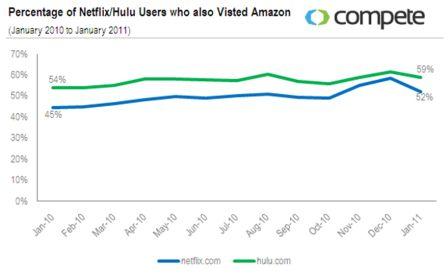

Video content owners "learned" from that experience and do their best to avoid ceding power to the newer distributors. But some might argue that some distributors have potential to grow so large that the potential audience simply cannot be ignored.

Some might argue that, over time, content owners "must" lose power to the huge new distributors. In that view, Amazon, Apple and possibly some others will amass audiences so large that the distributors will gain the upper hand. Who "owns" video distribution?

Certainly many would argue that perpetual annual price increases for video entertainment services at their current rate are unsustainable. And one almost-certain way to put the brakes on costs is for distributors to gain the ability to say "no" to programmer demands.

Network economics would change, of course. If programmers cannot "force" distributors to buy channel bundles, and distributors do not restrict channel bundles so rigidly, programming choices could explode.

Though telco, cable and satellite distributors might not prefer to sell smaller packages of channels, or simply programs, newer distributors might well prefer to sell that way. Think iTunes rather than a Comcast video subscription.

Many lightly-viewed networks would no longer be viable. Many shows would have a harder time getting exposure to an audience. But new promotion methods would arise. YouTube (News - Alert) Channels might become more important venues for specialty networks.

Some might question the long-term viability of the channel metaphor. But channels are akin to "genres" of music. People have favorite artists and songs. But they also have preferences for genres. The same will be true for video and movies. Both channels and a la carte can coexist.

Cable operators, though, are not likely to be as supportive of a la carte access to discrete programs as will Amazon and Apple, who have device and business ecosystems well suited to a la carte buying. Apple and Amazon have numerous other ways to make money than by selling advertising.

Video distributors make money on subscriptions and advertising, and both revenue streams potentially are disrupted by a la carte sales.

But the question remains: how big does a distributor have to be before content providers must be on the platform? In music, the answer has been "as big as Apple." So far, nobody in the video distribution business has yet reached that scale, apparently.

There are lots of potentially-huge channels. In the online world, Apple, Amazon and Google might come to mind. In the physical world, Wal-Mart, Target and Best Buy (News - Alert) already have tried to make a move. So far, though, all we have seen is cracks. The old order is not yet crumbling.

Gary Kim is a contributing editor for TMCnet. To read more of Gary’s articles, please visit his columnist page.

Edited by Rich Steeves